15.PUBLIC FINANCE

Public finance is a study of the financial aspects of Government. It Is concerned with the revenue and Expenditure of the public authorities and With adjustment of the one to the other.

Public Revenue:

Public revenue deals with the Methods of raising public revenue such as Tax and non-tax, the principles of taxation, Rates of taxation, impact, incidence and Shifting of taxes and their effects.

Public Expenditure:

This part studies the fundamental Principles that govern the Government Expenditure, effects of public expenditure and control of public expenditure.

Public Debt:

Public debt deals with the methods of raising loans from internal and external sources.The burden, effects and Redemption of public debt fall under this Head.

Financial Administration:

This part deals with the study of the Different aspects of public budget. The Budget is the Annual master financial Plan of the Government. The various Objectives and steps in preparing a public Budget, passing or sanctioning, allocation Evaluation and auditing fall within financial administration.

Fiscal Policy:

Taxes, subsidies, public debt and Public expenditure are the instruments of Fiscal policy.

Public finance and Private FinancePublic finance deals with study of income, expenditure, borrowingAnd financial administration of the Government. Private finance is the study of income, expenditure, borrowing and Financial administration of individual or private companies. Both public and private finance are fundamentally similar in nature but different from each other on various operational aspects. The Similarities and dissimilarities between Public and private finance have been Explained below.

Similarities:

Rationality:

Both public finance and private Finance are based on rationality. Maximization of welfare and least cost Factor combination underlie both.

Limit to borrowing:

Both have to apply restraint with Regard to borrowing. The Government Also cannot live beyond its means. There is a limit to deficit financing by the state Also.

Resource utilisation:

Both the private and public sectors have limited resources at their disposal. So both attempt to make optimum use of Resources.

Administration:

The effectiveness of measures of the Government as well as private depends on the administrative machinery. If the Administrative machinery is inefficient and corrupt it will result in wastages and Losses.

Dissimilarities:

- Income and Expenditure adjustment the government adjusts the income to the expenditure while individuals adjust their expenditure to the income. Private Finance involves stitching coat according To cloth available whereas public finance decides the cloth according to the need for the coat.

- Borrowing the government can borrow from Internal and external sources; it can Borrow from the people by issuing bonds. However, an individual cannot borrow from himself.

- Right to print currency the government can print currency. This involves the creation, distribution and monitoring of currency. The private Sector cannot create currency.

- Present vs. Future decisions the public finance is more involved with future planning and making long-Term decisions. These investments could include building of schools, hospitals and Infrastructure. The private finance makes financial decisions on projects with a Short term vision.

- Objective:

- The public sector’s main objective is to provide social benefit in the economy. The private sector aims to maximize Personal benefit i.e. Profit.Coercion to get revenue

- The sources of income of a private Individual is relatively limited while those of the Government is wide. The Government can use its power and Authority.

- Ability to make huge and deliberate Changes:

The public finance has the ability to make big decisions on income. For Example, it can effectively and deliberately adjust the revenue. But individuals cannot make such massive decisions.

Public Expenditure:

Public expenditure refers to Government spending incurred by Central, State and Local governments of a country.

Definition:

Public expenditure can be defined as, “The expenditure incurred by public Authorities like central, state and local Governments to satisfy the collective Social wants of the people is known as Public expenditure”.

Classification of public Expenditure are as follows:

Classification on the Basis of Benefit:

Cohn and Plehn have classified the Public expenditure on the basis of benefit into four classes:

- Public expenditure benefiting the entire Society, e.g., the expenditure on general Administration, defence, education, Public health, transport.

- Public expenditure conferring a special Benefit on certain people and at the Same time common benefit on the Entire community, e.g. administration Of justice etc.

- Public expenditure directly benefiting Particular group of persons and Indirectly the entire society, e.g. socialSecurity, public welfare, pension, Unemployment relief etc.

- Public expenditure conferring a special Benefit on some individuals, e.g., Subsidy granted to a particular industry.

Classification on the Basis of Function:

Adam Smith classified public Expenditure on the basis of functions of Government in the following main groups:

- Protection Functions: This group Includes public expenditure incurred on the security of the citizens, to protect from external invasion and internal Disorder, e.g., defence, police, courts Etc.

- Commercial Functions: This group Includes public expenditure incurred on the development of trade and Commerce, e.g., development of means of transport and communication etc.

- Development Functions: This group Includes public expenditure incurred For the development infrastructure and Industry Causes for the Increase in

Government Expenditure the modern state is a welfare state. In a welfare state, the government has to perform several functions viz Social, Economic and political. These activities are the cause for increasing public Expenditure.

Population Growth:

During the past 67 years of planning, the population of India has increased from36.1 crore in 1951, to 121 crore in 2011. The growth in population requires massive Investment in health and education, law and order, etc. Young population requires increasing expenditure on education & youth services, whereas the aging Population requires transfer payments like old age pension, social security & Health facilities.

Defence Expenditure:

There has been enormous increase In defence expenditure in India during Planning period. The defence expenditure Has been increasing tremendously due to Modernisation of defence equipment. The Defence expenditure of the government Was ₹ 10,874 crores in 1990-91 which Increased significantly to ₹ 2,95,511crores In 2018-19.

Government Subsidies:

The Government of India has been Providing subsidies on a number of Items such as food, fertilizers, interest on Priority sector lending, exports, education, Etc. Because of the massive amounts of Subsidies, the public expenditure has Increased manifold.

The expenditure on subsidies by Central government in 1990-91 was ₹ 9581 Crores which increased significantly to ₹ 3, 50,715.67 crores in 2023-24 Besides This, the corporate sectors also receive Subsidies (incentives) of more than ₹ 5 Lakh crores.

Debt Servicing:

The government has been borrowing Heavily both from the internal and external Sources, As a result, the government has to Make huge amounts of repayment towards Debt servicing.The interest payment of the central Government has increased from ₹ 21,500 Crores in 2023- 2024

Development Projects:

The government has been Undertaking various development projects Such as irrigation, iron and steel, heavy Machinery, power, telecommunications, Etc. The development projects involve huge investment.

Urbanisation:

There has been an increase in Urbanization. In 1950-51 about 17% of The population was urban based. Now the Urban population has increased to about 43%. There are more than 54 cities above One million populations. The increase in Urbanization requires heavy expenditure on law and order, education and civic Amenities.

Industrialisation:

Setting up of basic and heavy Industries involves a huge capital and long Gestation period. It is the government Which starts such industries in a planned Economy. The under developed countries Need a strong of infrastructure like Transport, communication, power, fuel, Etc.

Increase in grants in aid to state and Union territories:

There has been tremendous increase In grant-in-aid to state and union Territories to meet natural disasters.Public revenue occupies an important Place in the study of public finance. The Government has to perform several Functions for the welfare of the people. They involve substantial amount of public Expenditure which can be financed only Through public revenue. The amount of Public revenue to be raised depends on The necessity of public expenditure and The people’s ability to pay.

The income of the government Through all sources is called public income Or public revenue.

According to Dalton, the term “Public Income” has two senses — wide And narrow. In its wider sense it includes All the incomes or receipts which a public Authority may secure during any period Of time. In its narrow sense, it includes Only those sources of income of the public Authority which are ordinarily known as “revenue resources.” To avoid ambiguity, The former is termed “public receipts” and The latter “public revenue.”

In a narrow sense, it includes only Those sources of income of the Government Which are described as “revenue resources”. In broad sense, it includes loans raised by the Government also.

Classification of Public Revenue.Public revenue can be classified into two types.

Sources of Public Revenue:

- Tax Revenue

- Non – Tax Revenue

Tax is a compulsory payment by the Citizens to the government to meet the Public expenditure. It is legally imposed by the government on the tax payer and in No case tax payer can refuse to pay taxes to the government.

Characteristics of Tax:

- A tax is a compulsory payment made to the government. People on whom a tax is imposed must pay the tax. Refusal to pay the tax is a punishable offence.

- There is no quid pro quo between a Taxpayer and public authorities. This means that the tax payer cannot claim any specific benefit against the payment of a tax.

- Every tax involves some sacrifice on Part of the tax payer.

- A tax is not levied as a fine or penalty for breaking law.

Some of the tax revenue sources are

- Income tax

- Corporate tax

- Sales tax

- Surcharge and

- Cess

Non-Tax Revenue:

The revenue obtained by the Government from sources other than tax is called Non-Tax Revenue. The sources of Non-tax revenue are

Fees:

Fees are another important source Of revenue for the government. A fee is Charged by public authorities for rendering A service to the citizens. Unlike tax, there Is no compulsion involved in case of fees. The government provides certain services And charges certain fees for them. For Example, fees are charged for issuing of Passports, driving licenses, etc.

Fine:

A fine is a penalty imposed on an individual for violation of law. For Example, violation of traffic rules, payment of income tax after the stipulated time etc.

Earnings from Public Enterprises:

The Government also gets revenue By way of surplus from public enterprises. Some of the public sector enterprises do make a good amount of profits. The profits or dividends which the government gets can be utilized for public expenditure.

Special assessment of betterment levy:

It is a kind of special charge levied on certain members of the community who Are beneficiaries of certain government Activities or public projects. For example, Due to a public park or due to the Construction of a road, people in that Locality may experience an appreciation in the value of their property or land.

Gifts, Grants and Aids:

A grant from one government to Another is an important source of Revenue in the modern days. The Government at the Centre provides Grants to State governments and the state governments provide grants to the local government to carry out their functions.

Grants from foreign countries are known as Foreign Aid. Developing Countries receive military aid, food Aid, technological aid, etc. From other Countries

Escheats:

It refers to the claim of the state to the property of persons who die without Legal heirs or documented will.

Public Debt In the 18th and 19th centuries, the Role of the state was Minimum. But since 20th century there has been enormous Increase in the R e s p o n s i b i l i t i e s of the state. Hence the state has to Supplement the traditional revenue Sources with borrowing from individuals, and institutions within and outside the Country. The amount of borrowing is Huge in the under developed countries to Finance development activities. The debt Burden is a big problem and most of the Countries are in debt trap.

“The debt is the form of promises By the Treasury to pay to the holders of these promises a principal sum and in most instances interest on the principal. Borrowing is resorted to in order to provide Funds for financing a current deficit.”

Types of Public Debt:

Internal public debt:

An internal public debt is a loan Taken by the Government from the citizens Or from different institutions within the Country. An internal public debt only Involves transfer of wealth. The main sources of internal public debt Are as follows:

- Individuals, who purchase government Bonds and securities;

- Banks, both private and public, buy Bonds from the Government.

- Non-financial institutions like UTI, LIC, GIC etc. Also buy the Government Bonds.

- Central Bank can lend the Government In the form of money supply. The Central Bank can also issue money to meet the Expenditures of the Government.

External public debt:

When a loan is taken from abroad Or from an international organisation it Is called external public debt. The main Sources of External public debt are IMF, World Bank, IDA and ADB etc. Loan from Other countries and the Governments.

Causes for the Increase in Public debt:

The causes for enormous growth of public debt may be studied under the Following sub-headings:

Preparation of war:

Waging war has become one of the important causes for incurring debts by The governments. In modern times, the Preparation for war and nuclear defence Programmes take away the major share of the government’s revenue and so it incurs Debt.

Social obligations:

Modern states are considered to be ‘Welfare States’ and they have to undertake Many social obligations like public health, Sanitation, education,insurance, transport And communications, etc., besides Providing the minimum necessaries of lifeTo the citizens of the country. To finance these, the State has to incur a heavy public Debt.

Economic Development and Deficit:

The government has to undertake many projects for economic development Of the country. Construction of railways, Power projects, irrigation projects, heavy Industries, etc., could be thought of only By means of mobilising resources in the Form of public debt. Due to heavy public Expenditure, the governments always face Deficit budget. Such deficits have to be financed only through borrowings.

Employment:

Most of the governments of modern Days face the problem of unemployment And it has become the duty to solve this by Making huge public expenditure. To solve the unemployment problem, and to fight Recession, the government has to makeHuge expenditures. For this the States have To resort to public debt.

Controlling inflation:

The Government can withdraw Excess money from circulation, by raising Public debt and thus prevent prices from Rising.

Fighting depression:

During the depression phase, private Investment is lacking. The Government Applies compensatory public spending by borrowing from internal and external Sources.

Methods of Redemption of Public Debt:

The process of repaying a public debt Is called redemption. The Government Sells securities to the public and at the Time of maturity, the person who holds the Security surrenders it to the Government. The following methods are adopted for Debt redemption.

Sinking Fund:

Under this method, the Government establishes a separate fund known as “Sinking Fund”. The Government credits every year a fixed amount of money to this Fund. By the time the debt matures, the Fund accumulates enough amounts to pay off the principal along with interest. This Method was first introduced in England by Walpol.

Conversion:

Conversion of loans is another Method of redemption of public debt. It means that an old loan is converted intoA new loan. Under this system a high Interest public debt is converted into a Low interest public debt. Dalton felt that Debt conversion actually relaxes the debt Burden.

Budgetary Surplus:

When the Government presents Surplus budget, it can be utilised for repaying the debt. Surplus occurs when Public revenue exceeds the public Expenditure. However, this method is rarely possible.

Terminal Annuity:

In this method, Government pays off the public debt on the basis of terminal Annuity in equal annual instalments. This is the easiest way of paying off the public Debt.

Repudiation:

It is the easiest way for the Government to get rid of the burden of payment of a Loan. In such cases, the Government does not recognise its obligation to repay the Loan. It is certainly not paying off a loan but destroying it. However, in normal case The Government does not do so; if done it will lose its credibility.

Reduction in Rate of Interest:

Another method of debt redemption Is the compulsory reduction in the rate of Interest, during the time of financial crisis.

Capital Levy:

When the Government imposes Levy on the capital assets owned by an Individual or any institution, it is called Capital levy. This levy is imposed on Capital assets above a minimum limit onA progressive scale. The fund so collected Can be used by the Government for paying Off war time debt obligations. This is The most controversial method of debt Repayment.

Budget:

The word ‘budget’ is said to have Its origin from the French word “Bougett” Which refers to ‘a small leather bag’.The Budget is an annual financial statement Which shows the estimated income and Expenditure of the Government for the Forthcoming financial year.

“The budget has come to mean the Financial arrangements of a given period, With the usual implication that they Have been submitted to the legislature for Approval

Union Budget and State Budget India is a federal economy, hence Public budget is divided into two layers of The Government. According to the Indian Constitution, the Central Government Has to submit annual financial statement, i.e., Union Budget under Article 112 to the Parliament and each State Government Has to submit the same for the State in the Legislative Assembly under Article 202.

Types of Budget:

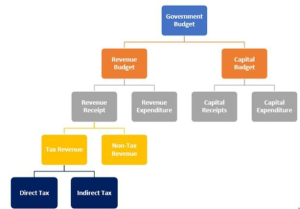

Revenue and Capital Budget:

On the basis of expenditure on Revenue account and other accounts, a Budget can be presented in two ways:

Revenue Budget: It consists of revenue Receipts and revenue expenditure. Moreover, the revenue receipts can be Categorised into tax revenue and non-tax Revenue. Revenue expenditure can also be Categorised into plan revenue expenditure And non-plan revenue expenditure.

Capital Budget: It consists of capital Receipts and capital expenditure. In this Case, the main sources of capital receipts Are loans, advances etc. On the other side Capital expenditure can be categorised Into plan capital expenditure and non-Plan capital expenditure.

Supplementary Budget: During the Time of war emergencies and natural Calamities like tsunami, flood etc, the Expenditures allotted in the budget Provisions are not always enough. Under These circumstances, a supplementary Budget can be presented by the Government to tackle these unforeseen Events.

Vote – on – Account: Under Article 116 of the Indian Constitution, the Budget can be presented in the middle of The year. The reason may be political in Nature. The existing Government may or May not continue for the year, on account Of the fact that elections are due, then the Government places a ‘lame duck budget’. This is also called ‘Vote-on-account Budget’.

The vote on account budget is a special Provision by which the Government gets Permission from the parliament to incur Expenditures on necessary items till the Budget is finally passed in the parliament.

The legal permission of both the Houses Of the parliament for the withdrawal of Money from the Consolidated Fund of India to meet the requisite expenses till The budget is finally approved is known As vote-on – account budget. This type Of budget is generally sanctioned for not More than two months.

Zero Base Budget: The Government Of India presented Zero-Base-Budgeting (ZBB first) in 1987-88. It involves Fresh evaluation of expenditure in the Government budget, assuming it as a new Item. The review has been made to provide Budget Receipts Budget Expenditure

- Revenue Receipts

- Revenue Expenditure

- Capital Expenditure

- Capital Receipts

Components of Budget:

- Recovery of Loans

- Borrowing and Other Liabilities

- Disinvestment

- Non – Tax Receipts

- Tax Receipts

- Plan Expenditure

- Non Plan Expenditure

A whole in the light of the socio-economic Objectives which have been already set up for this project and as well as in view of the priorities of the society.

Performance Budget: When the Outcome of any activity is taken as the Base of any budget, such budget is known As ‘Performance Budget’. For the first time in the world, the performance budget was made in USA. The Administrative Reforms Commission was set up in 1949 in America under Sir Hooper. This Commission recommended making of A ‘Performance Budget’ in USA. In the Performance Budget, it is the compulsion of the government to tell ‘what is done’, ‘how much done’ for the betterment of the People. In India, the Performance Budget is also known as ‘Outcome Budget’.

Balanced Budget Vs Unbalanced Budget:

Balanced Budget:

Balanced budget is a situation, In which estimated revenue of the Government during the year is equal to its Anticipated expenditure.Unbalanced Budget The budget in which Revenue & Expenditure are not equal to each other is Known as Unbalanced Budget.

Unbalanced budget is of two types:

- Surplus Budget

- Deficit Budget

Surplus Budget:

The budget is a surplus budget when The estimated revenues of the year are Greater than anticipated expenditures.Deficit BudgetDeficit budget is one where the Estimated government expenditure is More than expected revenue

In Parliament, the Budget goes through six stages:

- Presentation of Budget.

- General discussion.

- Scrutiny by Departmental Committees.

- Voting on Demands for Grants.

- Passing of Appropriation Bill.

- Passing of Finance Bill.

The Budget Division of the Department of Economic Affairs in the Finance Ministry is the nodal body responsible for preparing the Budget.

Changes Introduced in 2017:

Advancement of Budget presentation to February 1 (earlier presented on the last working day of February), Merger of Railway Budget with the General Budget.

Revenue Budget– It consists of the Revenue Expenditure and Revenue Receipts.

Revenue Receipts are receipts which do not have a direct impact on the assets and liabilities of the government. It consists of the money earned by the government through tax (such as excise duty, income tax) and non-tax sources (such as dividend income, profits, and interest receipts).

Revenue Expenditure is the expenditure by the government which does not impact its assets or liabilities. For example, this includes salaries, interest payments, pension, and administrative expenses.

Capital Budget– It includes the Capital Receipts and Capital Expenditure.

Capital Receipts indicate the receipts which lead to a decrease in assets or an increase in liabilities of the government. It consists of: (i) the money earned by selling assets (or disinvestment) such as shares of public enterprises, and (ii) the money received in the form of borrowings or repayment of loans by states.

Capital expenditure is used to create assets or to reduce liabilities. It consists of: (i) the long-term investments by the government on creating assets such as roads and hospitals, and (ii) the money given by the government in the form of loans to states or repayment of its borrowings.

Other Types of Budgets:

Zero Based Budgeting: Zero-based budgeting is a method of budgeting in which all expenses are evaluated each time a Budget is made and expenses must be justified for each new period.

Zero budgeting starts from the zero base and every function of the government is analysed for its needs and cost. Budget is then made based on the needs

Outcome Budget: Outcome Budget analyses the progress of each ministry and department and what the respected ministry has done with its Budget outlay. It measures the development outcomes of all government programs. It was first introduced in the year 2005.

Gender Budgeting: The gender-budgeting is defined as “gender-based assessment of Budgets, incorporating a gender perspective at all levels of the budgetary process and restructuring revenues and expenditures in order to promote gender equality”. It is actually budgeting for gender equity.

Through Gender Budget, the Government declares an amount to be spent over the development, Welfare, Empowerment schemes and programmes for Females.

Parliamentary Control over the BudgetIn India, the Government Accounts are Maintained in three parts:

- Consolidated Fund

- Contingency Fund

- Public Accounts

There are also two committees of Parliament, viz,

- The Public Accounts Committee,

- The Estimates Committee.

These committees keep a constant vigil on the expenditure so that no Ministry or Department exceeds the amount Sanctioned to it

Budgetary Deficits:

Budget deficit is a situation where Budget receipts are less than budget Expenditures. This situation is also known as government deficit reference to the Indian Government budget, budget deficit is of

Four major types:

- Revenue Deficit

- Budget Deficit

- Fiscal Deficit, and

- Primary Deficit

Revenue Deficit:

It refers to the excess of the Government revenue expenditure over Revenue receipts. It does not consider Capital receipts and capital expenditure. Revenue deficit implies that the Government is living beyond its means to conduct day-to-day operations.

Revenue Deficit (RD) = Total Revenue Expenditure (RE) – Total Revenue Receipts (RR),

Budget Deficit:

Budget deficit is the difference between total receipts and total Expenditure (both revenue and capital) Budget Deficit = Total Expenditure – Total Revenue

Fiscal Deficit:

Fiscal deficit (FD) = Budget deficit + Government’s market borrowings and Liabilities

Primary Deficit:

Primary deficit is equal to fiscal Deficit minus interest payments. It shows The real burden of the government and it Does not include the interest burden on Loans taken in the past. Thus, primary Deficit reflects borrowing requirement of The government exclusive of interest Payments.

Federal Finance:

Federal finance refers to the system of assigning the source of revenue to the Central as well as State Governments for The efficient discharge of their respective Functions i.e. clear-cut division is made regarding the allocation of resources of Revenue between the central and state Authorities.

Division of Powers: In our Constitution, There is a clear division of powers so That none violates its limits and tries to encroach upon the functions of the other and functions within own sphere of responsibilities. There are three lists Enumerated in the Seventh Schedule of Constitution. They are: the Union list, The State list and the Concurrent List.

TheUnion List consists of 100 subjects of national importance such as Defence, Railways, Post and Telegraph, etc.

The State List consists of 61 subjects of local interest such as Public Health, Police etc.

The Concurrent List has 52 subjects Important to both the Union and the State, such as Electricity, Trade Union, Economic and Social Planning, etCentral State Financial Relationship.

Union Sources:

- Corporation tax

- Currency, coinage and legal tender, Foreign exchange.

- Duties of customs including export Duties.

- Duties of excise on tobacco and certain Goods manufactured or produced in India.

- Estate duty in respect of property other Than agricultural land.

- Fees in respect of any of the matters in The Union List, but not including any Fees taken in any Court.

- Foreign Loans.

- Lotteries organized by the Government Of India or the Government of a State.

- Post Office Savings Bank.

- Posts and Telegraphs, telephones, Wireless, Broadcasting and other forms Of communication.

- Property of the Union.

- Public Debt of the Union.

- Rates of stamp duty in respect of Bills Of Exchange, Cheques, Promissory Notes, etc.

- Reserve Bank of India.

- Taxes on income other than agricultural Income.

- Taxes on the capital value of the Assets, exclusive of agricultural land of Individuals and companies.

- Taxes other than stamp duties on Transactions in stock exchanges and Future markets.

- Taxes on the sale or purchase of Newspapers and on advertisements Published therein.

- Terminal taxes on goods or passengers, Carried by railways, sea or air.

State Sources:

- Capitation tax

- Duties in respect of succession to Agricultural land.

- Duties of excise on certain goods Produced or manufactured in the State, Such as alcoholic liquids, opium, etc.

- Estate duty in respect of agricultural Land.

- Fees in respect of any of the matters in The State List, but not including fees Taken in any Court.

- Land Revenue.

- Rates of stamp duty in respect of Documents other than those specified in the Union List.

- Taxes on agricultural income.

- Taxes on land and buildings.

- Taxes on mineral rights, subject to Limitations impose by Parliament Relating to mineral development.

- Taxes on the consumption or sale of Electricity.

- Taxes on the entry of goods into a Local area for consumption, use or sale Therein.Taxes on the sale and purchase of Goods other than newspapers.

- Taxes on the advertisements other Than those published in newspapers.

- Taxes on goods and passengers carried By road or on inland waterways.

- Taxes on vehicles.

- Taxes on animals and boats.

- Taxes on professions, trades, callings and employments.

- Taxes on luxuries, including taxes on Entertainments, amusements, betting and gambling.

Taxes Levied and Collected by the Union but Assigned to the States (Art.269):

- Duties in respet of succession to Property other than agricultural land.

- Estate duty in respect of property other Than agricultural land.

- Taxes on railway fares and freights.

- Taxes other than stamp duties on Transactions in stock exchanges and Future markets.

- Taxes on the sale or purchase of Newspapers and on advertisements Published therein.

- Terminal taxes on goods or passengers Carried by railways, sea or air.

- Taxes on the sale or purchase of goods Other than newspapers where such sale or purchase taxes place in the course of Inter-State trade or commerce.

Duties levied by the Union but Collected and Appropriated by the States (Art.268)

Stamp duties and duties of excise on Medicinal and toilet preparation (those Mentioned in the Union List) shall be Levied by the Government of India but Shall be collected.

- In the case where such duties are Leviable within any Union territory, by The Government of India.

- In other cases, by the States within Which such duties are respectively Leviable.

Taxes which are Levied and Collected By the Union but which may be Distributed between the Union and The States (Arts.270 and 272)

- Taxes on income other than agricultural Income.

- Union duties of excise other than such Duties of excise on medicinal and Toilet preparations as are mentioned In the Union List and collected by the Government of India.“Taxes on income” does not include Corporation tax. The distribution of Income-tax proceeds between the Union and the States is made on the Recommendations of the Finance Commission.

Principles of Federal Finance:

In the case of federal system of finance, the following main principles must be applied:

- Principle of Independence.

- Principle of Equity.

- Principle of Uniformity.

- Principle of Adequacy.

- Principle of Fiscal Access.

- Principle of Integration and Coordination.

- Principle of Efficiency.

- Principle of Administrative Economy.

- Principle of Accountability.

- Principle of Independence Under the system of federal finance, A Government should be autonomous and free about the internal financial matters Concerned. It means each Government Should have separate sources of revenue, Authority to levy taxes, to borrow Money and to meet the expenditure. The Government should normally enjoy Autonomy in fiscal matters.

- Principle of Equity From the point of view of equity, the Resources should be distributed among the Different states so that each state receives a Fair share of revenue.

- Principle of Uniformity In a federal system, each state should Contribute equal tax payments for federal Finance. But this principle cannot be Followed in practice because the taxable capacity of each unit is not of the same.

- Principle of Adequacy of Resources The principle of adequacy means That the resources of each Government i.e. Central and State should be adequate to carry out its functions effectively. Here adequacy must be decided with reference to both current as well as future needs. Besides, the resources should be elastic In order to meet the growing needs and unforeseen expenditure like war, floods Etc.

- Principle of Fiscal Access In a federal system, there should be possibility for the Central and State Governments to develop new source of Revenue within their prescribed fields to meet the growing financial needs. In Nutshell, the resources should grow with the increase in the responsibilities of the Government.

- Principle of Integration and Coordination The financial system as a whole should be well integrated. There should be perfect coordination among different Layers of the financial system of the Country. Then only the federal system will survive. This should be done in such a way to promote the overall economic Development of the country.

- Principle of Efficiency: The financial system should be well Organized and efficiently administered. There should be no scope for evasion and Fraud. No one should be taxed more than once in a year. Double taxation should be avoided.

- Principle of Administrative Economy is the important criterion Of any federal financial system. That is,The cost of collection should be at the Minimum level and the major portion Of revenue should be made available For the other expenditure outlays of the Governments.

- Principle of Accountability Each Government should be Accountable to its own legislature for its financial decisions i.e the Central to the Parliament and the State to the Assembly.

History of Finance Commission:

Finance commission is a quasi-Judicial body set up under Article 280 of the Indian Constitution. It was Established in the year 1951, to define The fiscal relationship framework Between the Centre and the state.

Finance Commission aims to reduce The fiscal imbalances between the Centre and the states (Vertical Imbalance) and also between the States (horizontal imbalance). It Promotes inclusiveness.

A Finance Commission is set up Once in every 5 years. It is normally Constituted two years before the Period. It is a temporary Body.

The 14th Finance Commission was Set up in 2013. Its recommendations Were valid for the period from 1st April 2015 to 31st March 2020.

The 15th Finance Commission Has been set up in November 2017. Its recommendations will be Implemented starting 1 April 2020.

Functions of Finance Commission of India:

Article 280 (3) speaks about the Functions of the Finance Commission. The Article states that it shall be the Duty of the Commission to make the Recommendations to the President as to:

- The distribution between the Union And the States of the net proceeds of Taxes, which may be divided between them and the allocation among the States of the respective shares of such Proceeds;

- To determine the quantum of grants-In-aid to be given by the Centre to states [Article 275 (1)] and to evolve the Principles governing the eligibility of The state for such grant-in-aid;

Any other matter referred to the commission by the President of India In the interest of sound finance. Several Issues like debt relief, financing of Calamity relief of states, additional Excise duties, etc. Have been referred to The Commission invoking this clause.

Local Finance:

Local finance refers to the finance of local bodies in India. There is a large Variety of local bodies in India. We have the following main four local bodies which are functioning today in our country:

Types of Local Bodies:

- Village Panchayats

- District Boards or ZilaParishads

- Municipalities

- Municipal Corporations

Village Panchayats:

Establishment: The jurisdiction of A panchayat is usually confined to one Revenue village. In some cases, though Not very frequently, two or more small Villages are grouped under one panchayat. The establishment of panchayat raj is the avowed policy of most states in India.

Functions:

- The functions of panchayats range over a wide area including civil, economic And so on. Thus small disputes may be disposed of by panchayats on the spot.Roads, primary schools, village Dispensaries etc. Are to be managed by Panchayats.

- The supply of water, both for drinking And irrigation, falls within their field of responsibility, and in some cases Farming, marketing, storage, etc. Are entrusted to them.

Sources of revenue of Village Panchayats the following are the sources of Revenue of village panchayats.

- General property tax,

- Taxes on land,

- Profession tax, and

- Tax on animals and vehicles.

Other taxes include service tax, Octroi, theatre tax, pilgrim tax, tax on Marriage, tax on birth and deaths, and Labour tax. As a matter of fact, taxes are Levied by the panchayats only with the Sanction of the state government, and There are certain limits in respect of tax Rates which have to be observed.

District Boards or ZilaParishads:

Establishment: In rural areas, district Boards or Zila Parishads are established atDistrict level. The territorial jurisdiction of a district board is generally a revenue District.

Functions: In Tamil Nadu, the Zila Parishad Is a co-ordinating body which exercises General supervision over the working of Panchayat Samitis and advises them on Implementation of Development Schemes. Sources of revenue of District Boards

- Grants-in-aid from the state Government.

- Land Cesses.

- Toll, fees etc.

- Income from the property and loans from the state governments.

- Grants for the centrally sponsored Schemes relating to development Work.

- Income from fairs and exhibitions.

- Property tax and other taxes which the state governments may authorise the district boards.

Municipalities:

Establishment and Functions: The Municipalities are bodies or institutionsWhich are established in urban areas For looking after local affairs, such as, Sanitation, public health, local roads, Lighting, water supply, cleaning of streets, Maintenance of parks and gardens, Maintenance of hospitals, dispensaries And veterinary hospitals, provision of Drainage, provision of primary education, Organising of fairs and exhibitions Etc. However, all these functions are performed subject to the control of the State government.

- Sources of revenue of municipalities

- Taxes on property

- Taxes on goods,

- Octroi and terminal tax

- Personal taxes, taxes on profession,

- Trades and employment

- Taxes on vehicles and animals

- Theatre or show tax, and

- Grants-in-aid from state government.

Municipal Corporations:

Establishment and Functions: The municipal corporations have Wide powers and enjoy greater freedom as Compared to municipalities. The municipal Corporations are usually entrusted with the functions, such as, water supply andDrainage, lighting, roads, slum clearance, Housing and town planning etc. The Rapid increase in the population of cities has definitely added to the functions of Municipal corporations.

Sources of revenue of Corporations:

- Tax on property,

- Tax on vehicles and animals,

- Tax on trades, calling and employment,

- Theatre and show tax,

- Taxes on goods brought into the cities

- Taxes on advertisements,

- Octroi and terminal tax etc.

The corporations have a fair degree Of freedom in respect of their choice and Modification of these taxes, subject to the Maximum and minimum rates laid down by the law.

FRBM Act:

The Fiscal Responsibility and Budget Management Act, 2003 (FRBMA) is an Act of the Parliament of India to institutionalize financial discipline, reduce India’s fiscal deficit, improve macroeconomic management and the overall management of the public funds by moving towards a balanced budget.

Objectives:

- Reduction of fiscal deficit and revenue deficit;

- To achieve inter-generational equity in fiscal management by reducing the debt burden of the future generation;

- Achieving long-term macroeconomic stability;

- Better coordination between fiscal and monetary policy;

- Transparency in fiscal operations of the Government.

Major Provisions of the FRBM Act, 2003:

- The FRBM rule set a target reduction of fiscal deficit to 3% of the GDP by 2008-09. This will be realized with an annual reduction target of 0.3% of GDP per year by the Central government.

- Revenue deficit has to be reduced by 0.5% of the GDP per year with complete elimination by 2008-09.

Reduction of Public Debt:

- The government has to take appropriate measures to reduce the fiscal deficit and revenue deficit so as to eliminate revenue deficit by 2008-09 and thereafter, sizable revenue surplus has to be created.

- It mandated setting annual targets for the reduction of fiscal deficit and revenue deficit, contingent liabilities and total liabilities.

- The government shall end its borrowing from the RBI except for temporary advances.

- The RBI was supposed to not subscribe to the primary issues of the central government securities after 2006.

- The revenue deficit and fiscal deficit may exceed the targets specified in the rules only on grounds of national security, calamity and other exceptional grounds to be specified by the Central government.

- Amendments to FRBM Act: Fiscal Responsibility and Budget Management Act, 2003 was amended in 2012 that mandated the Central Government to lay before the Houses of Parliament, Macro-Economic Framework Statement, Medium Term Fiscal Policy Statement and Fiscal Policy Strategy Statement along with the Annual Financial Statement and Demands for Grants.

- NK Singh committee, that was set up in 2016 to review the FRBM Act, recommended that the government must target a fiscal deficit of 3% of the GDP in the years up to March 31, 2020, subsequently cut it to 2.8% in 2020-21 and to 2.5% by 2023.